There are legit loan apps, which we will be discussing in this article, and there are loan sharks (loans apps you should avoid). There used to be a time when taking loans was a difficult task, even for business owners. The process was still very stressful.

With the advent of technology, accessing loans for both personal and business use has gotten easier. We cannot deny the fact that individuals will need extra cash to handle some financial issues around them, as this could be both for personal and business use. When they run out of options on where to get this extra cash, the best alternative will be to apply for a quick and easy loan online.

What are loan apps?

These are mobile tools designed to allow individuals to apply for a loan without setting foot in a bank. They give one the opportunity to borrow money with an online application.

Here’s a list of legit loan apps in Nigeria

Branch

Branch is a platform in Nigeria that provides instant loans online. With over 10 million downloads, the app is currently among the most popular and reliable ones in the lending category on Google Play.

The app uses information from users’ smartphones to determine loan eligibility and personalise loan offers. Depending on the user’s risk tolerance, the app’s monthly interest rates range from 3% to 23%. Depending on your history of repayment, you can apply for personal loans with a tenure of 62 days to a year and a range of amounts from 2,000 to 500,000 naira within 24 hours.

With Branch, there are no late or rollover fees, and no collateral is needed.

How to borrow from Branch

- Download Branch for your Android device from the Google Play Store.

- To create your account, kindly complete the short form and submit it for a quick inspection.

- When you submit a loan application, the funds will be transferred instantly to your bank account or mobile money.

- Make use of your smartphone to make the loan repayments and raise your credit score to gain access to bigger loans in the future.

Carbon

Carbon, formerly PayLater, is an easy-to-use, entirely digital lending platform that offers short-term loans to Nigerian citizens and small businesses to help with unforeseen costs or immediate cash needs.

With Carbon, you have immediate access to unsecured loans up to one million naira. The funds are normally sent within 1–3 business days after your application has been approved. You may be able to obtain larger credit limits for your subsequent loan if you make on-time repayments.

Carbon is available both on the iOS platform for Apple mobile devices and on Android devices. From our observation, Carbon is also the best loan app in Nigeria for iPhones.

Once you can pay your loan on time, you are entitled to greater loan amounts, lower interest rates, and cashback on the interest you pay.

The Carbon loan app doesn’t charge late fees, rollover fees, or processing fees due to its solid reputation for dependability. Users only pay what they owe; this feature is a highly desired characteristic demanded of all of Nigeria’s top loan applications.

How to borrow from Carbon

- Download and install the Carbon app from the App Store or Google Play Store.

- By providing your information, you are one step closer to getting your loan. It is safe and secure.

- Once you have chosen how much you want to borrow, Carbon will review your application and let you know if you qualify.

- If you qualify, Carbon will immediately put the money into your account after it has been approved.

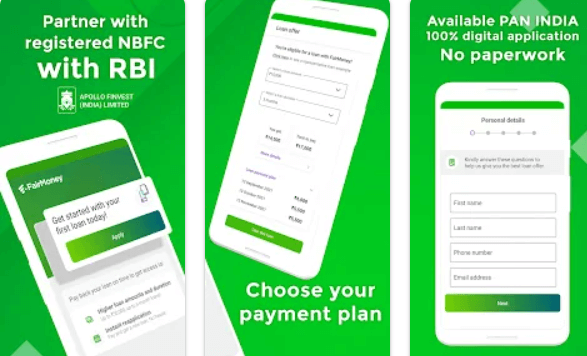

Fairmoney

The Google Play Store app FairMoney, which has received over 10 million downloads, provides quick loans within 5 minutes with no paperwork or collateral needed. It is regarded as one of the fastest loan apps in Nigeria. Depending on your smartphone’s data and repayment history, the loan amount changes.

The loan amounts range from 1,500 to 1 million naira, and the 61- to 18-month payback terms have interest rates that range from 2.5% to 30% each month.

When applying for a loan, you must link your card or bank account and provide your BVN information in order to pay back your loan.

Due to the law, you run the danger of losing your FairMoney account as well as a credit report to CRC and FirstCentral if you attempt to default on the loan.

On the Google Play Store, Fairmoney is one of the Nigerian loan applications with the best ratings. It abides by the EU General Data Protection Regulation, the strictest privacy and security regulation in the world, since it is based in Europe.

How to borrow from Fairmoney

- Download and install the app on the Google Play Store.

- You must register using the phone number associated with your BVN and respond to a few questions in order to receive a loan offer.

- Your loan will be transferred immediately to your preferred bank account if you agree to it.

Palmcredit

PalmCredit makes it simple to get a loan at any time and anywhere. On your cell phone, Palmcredit provides loans up to 100,000 naira within minutes.

Obtaining a mobile loan with PalmCredit is simple. You can take as many immediate loans as you need without additional approval after applying for your credit limit in just a few minutes.

Your credit score is updated as soon as you make the repayment. Repay on time to see your 100,000 naira limit increase.

The Palmcredit quick loan app, one of the fastest-growing loan apps in Nigeria, has grown in popularity as a mobile lending app in Nigeria since it enables users to take out as many short-term loans as they like without having to wait for approval.

How to borrow from Palm Credit

- You can download and install the Palm Credit Loan app from the Google Play Store.

- Open the app, then register an account.

- Fill in all the necessary blanks on the form before submitting it.

- You can input your desired withdrawal amount and repayment method on the withdrawal page.

- To begin a withdrawal request after visiting the withdrawal page, enter the withdrawal amount and repayment method.

- Until you apply for a loan, Palm Credit won’t lend you any money.

Okash

For mobile phone customers in Nigeria, Blue Ridge Microfinance Bank Limited manages Okash, a practical and efficient online loan platform. Customers’ financial demands are fully met by OKash online and round-the-clock. The loan amount is deposited into the applicant’s bank account after only a few simple steps and little paperwork in the application procedure. The app offers loans with repayment terms ranging from 91 days to 365 days and amounts ranging from 3,000 to 500,000 naira.

The range of the company is 0.1% to 1%. The daily calculation of the Okash interest rate results in an annual percentage rate (APR) that ranges from 36.5% to 360%. More than 5 million people have downloaded the OKash app.

How to borrow from Okash

- Install the OKash app from the Google Play Store.

- Register for an account.

- Select the product you would like to apply for.

- Fill out your basic information, then submit the application.

- After the submission, you may receive a call for verification.

- E-sign the loan agreement after the approval.

Aella Credit

In about 5 minutes, Aella Credit offers quick and simple access to loans. You can raise your credit limit and your credit score without any paper records by making on-time repayments. You only need a smartphone (iOS or Android) and your basic information, along with your BVN.

The app, which has received over 1 million downloads, offers loans with a tenure of 61 days to 365 days and a range of 2,000 to 1.5 million naira. Its monthly interest rate runs from 2% to 20%, and its annual percentage rate (APR) is 22% to 264%.

How to borrow from Aella Credit

- Download the app from the Google Play Store or on iOS.

- Create a profile.

- Fill up all required fields with accurate and useful information.

- To find out how much you are eligible to borrow, click the “Check Eligibility” option.

- Make use of a loan application that fits your needs.

- The money will be added to your Aella wallet.

Frequently Asked Questions

What happens if I can’t pay before the due date?

It is advisable that you only take out loans that you are certain you can pay back. There are loan apps that charge extra for late repayments, while others don’t.

Conclusion

As much as individuals are grateful for the easy access to loans via loan apps. It is wise to carefully review their Terms and Conditions (T&C) before submitting an application, despite the fact that the majority of these platforms advertise rapid loans without any kind of security.

Before taking any loan, it is important to consider the interest rate and repayment time. If you are a business, you should avoid taking out loans with a very short payback period unless you are absolutely certain that you will quickly repay your costs.